It is very unusual to see a stock these types of as Bajaj Finance appropriate by 24 for each cent article its March quarter (Q4 FY22) final results. For prolonged it has been the favorite amid traders, significantly in the economic expert services area and the steady soften down in its stock rates article Q4 success nudges a person to feel if all is very well with Bajaj Finance.

The superior aspect is that the loan company remains a structurally powerful engage in in the consumer finance house. Just about with small competition to destabilise its management placement and the loan company getting weathered the pandemic reasonably properly augers effectively for buyers. But here’s the not-so-comforting component.

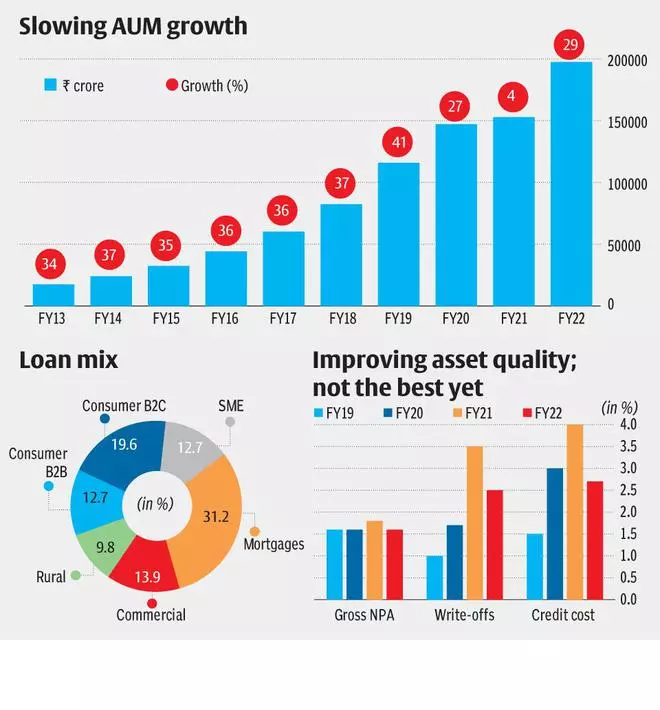

For a enterprise that grew upwards of 30 – 35 per cent 12 months-on-year in phrases of its financial loan guide, the advancement price may well taper going forward. With target now on creating its electronic fortress of goods, platforms (application and world wide web) and shopper retention, and Bajaj Finance’s individual foundation inflammation to a level where by high-quality should really take precedent above amount, it would be prudent for buyers to bake in decrease valuations. At this time at 6.2 moments FY23 rate to reserve, Bajaj Finance’s inquiring price has shrunk by 22 for each cent write-up success. If the craze of slowdown in pace of buyer acquisition or new financial loans additions persists, there could be additional correction in valuations. Investors can use these corrections to accumulate the Bajaj Finance stock. Despite slower expansion, the lender’s favourable positioning in the marketplace, which is unlikely to be challenged, helps make for a circumstance to invest in the stock in dips.

But here’s the capture. Can Bajaj Finance stock be the multi-bagger that it was in the last 10 years? Quite not likely. Bajaj Finance is in the place as HDFC Bank, exactly where measurement will be a dominant factor. For a non-bank with virtually ₹2 lakh crore of mortgage guide, it will have to tread thoroughly on progress right here on.

Business design

At a time when purchasing air conditioners or washing machines on credit was uncommon, Bajaj Finance practically made it a norm and popularised the concept of zero-interest credit. This was in the lender’s first stage. In the next period, also the intervals of quickly progress (FY13 – FY19), when Bajaj Finance grew its mortgage e-book practically 10-fold from ₹17,500 crore to ₹1.15 lakh crore, it took the lessons from purchaser durables lending organization to across products. From attractiveness parlour visits to obtaining home furnishings to subscribing to Bjyu’s on the net classes, Bajaj Finance was existing almost everywhere.

It also tied up with RBL Financial institution and DBS to co-situation credit history cards, however Bajaj Finance on a standalone foundation also presents challenging battle to credit history cards. This period of time also marked the company’s foray into housing finance area and with this, the loan provider has a robust bouquet of credit score products and solutions to tackle distinctive segments of borrowers.

By late FY20, Bajaj Finance started experiencing competition from an unseen corner – the fintechs. Their freebies and cashbacks begun ingesting into its pie of prospects. The trend became distinguished during the pandemic and hence the need to have to speed up its electronic penetration come to be crucial.

Bajaj Finance 3.

In October 2020, Bajaj Finance unveiled its options to grow to be the ‘moment of truth’ firm throughout all items and providers and a quarter later on it chalked out its foray into the digital area. Calling it the omnichannel framework, the intention was to provide, keep and grow its shopper foundation in a digital or offline mode as for every the customer’s preference.

The app is specific at retail and business buyers and cross provide products and solutions of its Bajaj Finserv these kinds of as insurance policy and mutual resources. Bajaj Finance is in the course of action of replicating its digital choices on the web site for far better customer access and engagement. The purpose of the electronic platform is to retain buyer and to that extent it is a lot more a price tag model fairly than income turbines. Exact same is the logic with the payments enterprise, a comprehensive roll out of which is owing in FY23. But will this accelerate customer acquisition fee?

Way ahead

The intention guiding fortifying the digital existence is to bump up the customer acquisition, a metric important for mortgage development and profitability. On the other hand, considering the fact that mid-FY20, slowdown in Bajaj Finance’s business enterprise turned quite apparent, though the bounce again led by revenge obtaining (or revenge selling from Bajaj Finance’s viewpoint) was pretty robust. On the other hand, the restoration is not holding up adequately, as it did in the previous – no matter whether the periods post demonetisation or GST roll out in FY17 and FY18 respectively. But then would it be prudent for the loan company to replicate its historic expansion amounts? Not very.

At a mortgage book sizing of ₹1.95 lakh crore as on Q4 FY22, Bajaj Finance will be tasked with juggling in between expansion, profitability and asset excellent. The regulator’s intention also is that large NBFCs expand in a calibrated fashion. Owning dismissed the choice of seeking a financial institution license for at least 3 yrs, contending with slower speed of development may well be the new regular for Bajaj Finance, in particular provided that the credit score cost and write-offs remained superior for a consecutive yr in FY22. Investors want to view FY23 as a interval of a healing and normalisation of asset high-quality, which alone could prohibit Bajaj Finance from ambitiously expanding its personal loan ebook. In that case, Bajaj Finance’s need to have to command super-standard valuations premium will be questioned.

Valuations

In the last five yrs, HUL has traded at upwards of 40 occasions price to earnings. Regardless of constant opposition and durations of slower than expected development, it has held on to its premium. Bajaj Finance stock is very equivalent to HUL. It may possibly keep on being the most high-priced stock in the money services place. The company’s capability to increase resources at the least expensive cost (6.7 for each cent in Q4) and retain its over-all internet fascination margin persistently in the 9 – 10 for each cent array are its critical positives.

But in complete terms, despite the 22 for every cent correction in valuations, which delivers the inventory to 6.2 periods FY23 believed e-book, there is a scenario for a more valuation correction.

Investors were being willing to shell out major dollar for the stock for its skill to constantly outpace friends in terms of development. With that factor very likely to be lacking in the close to- to medium-phrase, a correction in valuation is but reasonable. Even so, offered Bajaj Finance’s administration pedigree, its execution skill and management position, which even banking companies haven’t been able to dent meaningfully, we advise our visitors to use the corrections to accumulate the stock.

Revealed on

May possibly 14, 2022